How to Calculate IRR: A Comprehensive Guide

The Internal Rate of Return (IRR) is a crucial financial metric used to evaluate the profitability of investments. It represents the annualized rate of return that an investment is expected to generate over its lifetime, taking into account the time value of money. Calculating IRR accurately is essential for making informed investment decisions.

The formula for calculating IRR is complex and requires iterative methods such as the Newton-Raphson method or financial calculators. However, it can be simplified into the following steps:

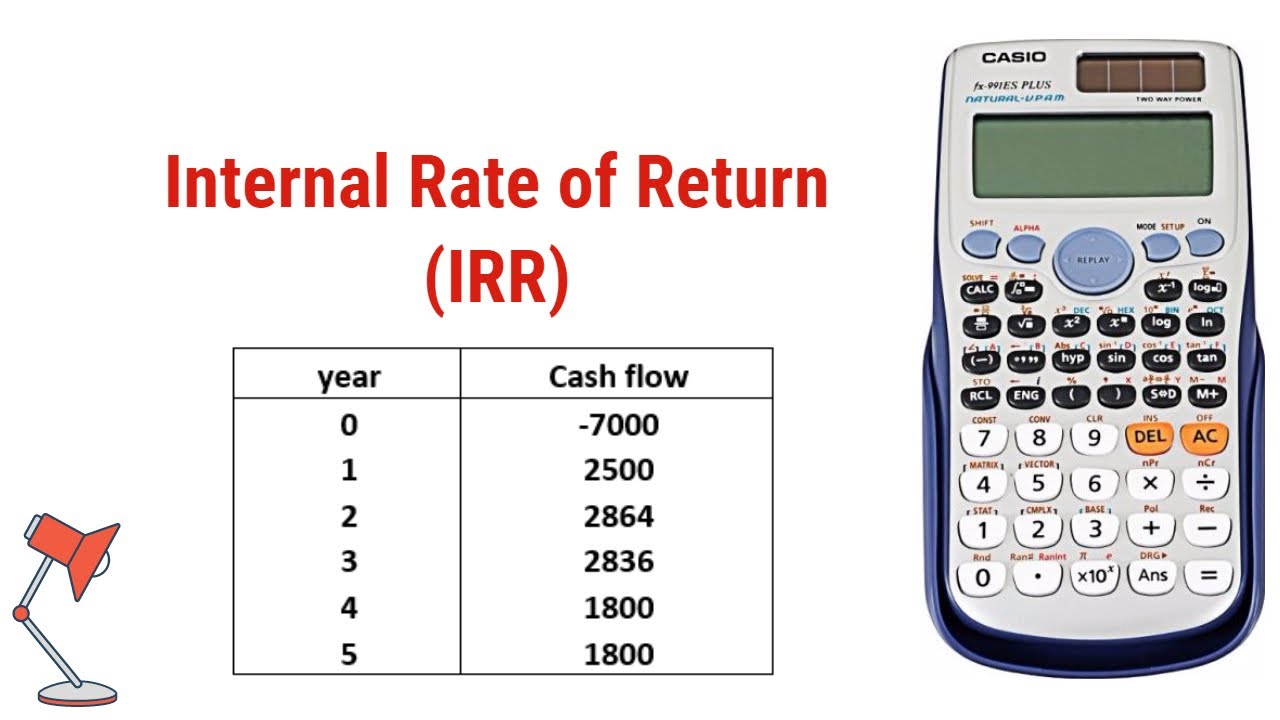

- Identify the cash flows associated with the investment.

- Estimate the initial investment cost.

- Guess an IRR value (e.g., 10%).

- Calculate the Net Present Value (NPV) of the cash flows using the guessed IRR.

- If the NPV is positive, the guessed IRR is too low. If the NPV is negative, the guessed IRR is too high.

- Refine the IRR guess and repeat steps 4-5 until the NPV is close to zero.

- The resulting IRR value is the estimated annualized return rate of the investment.

IRR is a valuable tool for comparing different investment opportunities and making decisions about capital allocation. It provides a comprehensive measure of profitability that considers both the magnitude and timing of cash flows.

How to Calculate IRR

Calculating the Internal Rate of Return (IRR) is crucial for evaluating the profitability of investments. Here are six key aspects to consider when calculating IRR:

- Cash Flows: Identify and estimate the cash flows associated with the investment.

- Initial Cost: Determine the initial investment cost or outlay.

- Guess and Check: Use an iterative method to guess an IRR and refine it until the Net Present Value (NPV) is close to zero.

- Time Value of Money: IRR considers the time value of money, recognizing that cash flows received sooner are more valuable than those received later.

- Multiple IRRs: In some cases, an investment may have multiple IRRs, indicating potential risks or complexities.

- Comparison Tool: IRR allows for comparing different investment opportunities on an equal footing, considering both the magnitude and timing of cash flows.

These aspects are interconnected and crucial for accurately calculating IRR. Understanding and considering them ensures informed investment decisions. For example, if an investment has significant cash flows early on, it will likely have a higher IRR compared to an investment with late cash flows. Additionally, IRR can be used to compare investments with different risk profiles, helping investors make appropriate choices based on their risk tolerance.

Cash Flows

In calculating the Internal Rate of Return (IRR), identifying and estimating cash flows accurately is paramount. Cash flows represent the inflows and outflows of money associated with an investment over its lifetime. They are the foundation upon which IRR is built.

The importance of cash flows in IRR calculation lies in the time value of money concept. IRR considers the present value of future cash flows, recognizing that money received sooner is more valuable than money received later. By incorporating the timing of cash flows, IRR provides a more accurate measure of an investment's profitability.

For instance, consider two investments with the same total cash flow but different timing. Investment A generates cash flows evenly over five years, while Investment B generates a significant cash flow in the final year. Investment B may appear more lucrative based on total cash flow, but IRR would reveal that Investment A has a higher IRR due to the earlier receipt of cash flows.

Accurately estimating cash flows requires careful analysis of the investment's underlying factors, such as revenue streams, operating expenses, and capital expenditures. Overestimating cash flows can lead to an inflated IRR, while underestimating cash flows can result in an overly conservative IRR.

In conclusion, identifying and estimating cash flows associated with an investment is a crucial step in calculating IRR. By considering the timing and present value of cash flows, IRR provides a comprehensive measure of investment profitability and enables informed decision-making.

Initial Cost

In calculating the Internal Rate of Return (IRR), determining the initial cost or outlay is crucial as it sets the baseline against which future cash flows are evaluated. The initial cost represents the upfront investment required to initiate a project or acquire an asset, and it directly impacts the IRR calculation.

The importance of initial cost in IRR calculation lies in the time value of money concept. IRR considers the present value of future cash flows, and the initial cost is the first cash outflow that reduces the present value of subsequent inflows. A higher initial cost means a lower present value of future cash flows, which in turn can lead to a lower IRR.

For instance, consider two investments with the same future cash flows but different initial costs. Investment A has an initial cost of $100,000, while Investment B has an initial cost of $50,000. Assuming the same future cash flows, Investment B will have a higher IRR because the initial cost is lower, resulting in a higher present value of future cash flows.

Accurately determining the initial cost requires careful assessment of all expenses incurred at the start of the investment. This includes not only the purchase price of the asset but also any associated fees, such as legal fees, transaction costs, or installation costs. Overestimating the initial cost can lead to an artificially low IRR, while underestimating the initial cost can result in an overly optimistic IRR.

In conclusion, determining the initial cost or outlay is a critical component of IRR calculation. By considering the impact of initial cost on the present value of future cash flows, IRR provides a more accurate measure of investment profitability and enables informed decision-making.

Guess and Check

In calculating the Internal Rate of Return (IRR), the "guess and check" method is an iterative process that plays a crucial role in determining the IRR accurately. It involves estimating an IRR, calculating the Net Present Value (NPV) using that IRR, and refining the IRR guess based on the NPV.

- Convergence and Accuracy: The iterative nature of the guess and check method ensures convergence to the true IRR. By repeatedly refining the IRR guess, the NPV is brought closer to zero, resulting in a more accurate IRR calculation.

- NPV as a Guide: The NPV serves as a guide in the guess and check process. A positive NPV indicates that the guessed IRR is too low, while a negative NPV indicates that the guessed IRR is too high. This guidance helps refine the IRR guess in each iteration.

- Computational Efficiency: The guess and check method is computationally efficient, especially for simple cash flow patterns. It does not require complex mathematical formulas or specialized software, making it accessible for various users.

- Limitations and Alternatives: While the guess and check method is widely used, it has limitations. For complex cash flow patterns, convergence may be slow or may not be achieved. In such cases, alternative methods like the Newton-Raphson method or financial calculators may be preferred.

Overall, the guess and check method is a fundamental component of IRR calculation, providing a practical and iterative approach to determining the IRR. Its convergence properties, use of NPV as a guide, computational efficiency, and limitations make it a valuable tool in evaluating investment profitability.

Time Value of Money

The Time Value of Money (TVM) is a fundamental concept in finance that recognizes the different value of money at different points in time. IRR takes TVM into account when calculating the profitability of an investment, giving more weight to cash flows received sooner rather than later.

- Discounted Cash Flows: IRR uses discounted cash flows to calculate the present value of future cash flows. By discounting future cash flows, IRR effectively reduces their value to reflect the time value of money. This ensures that cash flows received sooner have a greater impact on the IRR calculation compared to those received later.

- Net Present Value (NPV): NPV is a metric used in conjunction with IRR to evaluate investments. NPV calculates the present value of all future cash flows using a specified discount rate. A positive NPV indicates that the investment is profitable, considering the time value of money.

- Investment Decisions: IRR helps investors make informed decisions about which investments to undertake. By considering the time value of money, IRR provides a more accurate measure of an investment's profitability compared to methods that do not account for TVM.

In conclusion, the Time Value of Money plays a crucial role in IRR calculations. By recognizing that cash flows received sooner are more valuable, IRR provides a more comprehensive and accurate assessment of an investment's profitability, enabling investors to make informed decisions.

Multiple IRRs

In the context of calculating the Internal Rate of Return (IRR), the possibility of multiple IRRs is a significant consideration. Multiple IRRs arise when the cash flow pattern of an investment is non-conventional or complex.

- Non-Traditional Cash Flows: When an investment involves non-traditional cash flows, such as multiple sign changes or irregular timing, it may result in multiple IRRs. These non-traditional patterns can make it challenging to accurately determine the profitability of the investment.

- Risk and Complexity: The presence of multiple IRRs often indicates potential risks or complexities associated with the investment. It can suggest underlying assumptions or factors that require careful examination and analysis.

- IRR as a Screening Tool: Despite the challenges, IRR remains a valuable screening tool for investments. By identifying multiple IRRs, investors can gain insights into the potential risks and complexities of an investment, prompting further investigation and due diligence.

- IRR Limitations: It's important to recognize the limitations of IRR when dealing with multiple IRRs. In such cases, alternative evaluation methods, such as Net Present Value (NPV) analysis, may provide a more comprehensive assessment of investment profitability.

In conclusion, understanding the implications of multiple IRRs is crucial in calculating IRR. It highlights potential risks or complexities associated with the investment, prompting investors to conduct thorough analysis and consider alternative evaluation methods to make informed investment decisions.

Comparison Tool

The Internal Rate of Return (IRR) serves as a powerful comparison tool for evaluating and selecting among various investment opportunities. Its significance lies in its ability to consider both the magnitude and timing of cash flows, providing a comprehensive assessment of an investment's profitability.

To understand the connection between IRR and comparing investment opportunities, let's consider the following scenario: an investor has two potential investments, A and B. Investment A offers a higher total cash flow but spread over a longer period, while Investment B offers a lower total cash flow but received sooner. Simply comparing the total cash flows would favor Investment A. However, IRR takes into account the time value of money, recognizing that cash flows received sooner are more valuable than those received later. As a result, IRR may reveal that Investment B, despite its lower total cash flow, has a higher IRR due to the earlier receipt of cash flows.

The practical significance of this understanding is immense. By using IRR as a comparison tool, investors can make informed decisions about which investments offer the best returns, considering both the magnitude and timing of cash flows. This is particularly important in capital allocation and portfolio management, where investors seek to optimize their returns while managing risks.

In conclusion, the connection between IRR as a comparison tool and its ability to consider both the magnitude and timing of cash flows is fundamental to calculating IRR. By providing a comprehensive assessment of investment profitability, IRR empowers investors to make informed decisions and achieve their financial goals.

FAQs on Calculating IRR

Calculating the Internal Rate of Return (IRR) is crucial for evaluating the profitability of investments. Here are answers to some frequently asked questions about IRR calculation:

Question 1: What is the importance of cash flows in IRR calculation?

Cash flows are essential because IRR considers the time value of money. Cash flows received sooner have a greater impact on IRR compared to those received later. Accurately estimating cash flows is critical for obtaining a reliable IRR.

Question 2: How do I determine the initial cost for IRR calculation?

The initial cost represents the upfront investment required. It directly affects IRR because it reduces the present value of future cash flows. Carefully assess all expenses incurred at the start of the investment, including the purchase price and any associated fees.

Question 3: Why is the "guess and check" method used in IRR calculation?

The "guess and check" method is an iterative process that helps refine the IRR estimate. By repeatedly guessing an IRR and calculating the Net Present Value (NPV), the method converges to the true IRR, ensuring accuracy.

Question 4: How does IRR account for the Time Value of Money?

IRR uses discounted cash flows, which reduce the value of future cash flows to reflect their present value. This ensures that cash flows received sooner are more heavily weighted in the IRR calculation.

Question 5: What are the implications of multiple IRRs?

Multiple IRRs can arise when cash flow patterns are non-traditional. They may indicate potential risks or complexities, and warrant further analysis. In such cases, alternative evaluation methods like Net Present Value (NPV) can provide a more comprehensive assessment.

Question 6: How can IRR be used to compare investment opportunities?

IRR allows for comparing investments by considering both the magnitude and timing of cash flows. It provides a comprehensive measure of profitability that helps investors make informed decisions about which investments offer the best returns.

Summary: Calculating IRR involves careful consideration of cash flows, initial cost, and the time value of money. Understanding the implications of multiple IRRs and using IRR as a comparison tool are essential for accurate investment evaluation.

Next Section: Benefits and Applications of IRR

Conclusion

In conclusion, calculating the Internal Rate of Return (IRR) is a fundamental skill for evaluating investment opportunities. By considering the time value of money, IRR provides a comprehensive measure of profitability that incorporates both the magnitude and timing of cash flows. Accurately calculating IRR requires careful estimation of cash flows, determination of the initial cost, and understanding of the iterative "guess and check" method.

IRR is a powerful tool that enables investors to make informed decisions about capital allocation and portfolio management. It allows for comparing different investments on an equal footing, taking into account the unique cash flow patterns of each opportunity. Understanding the implications of multiple IRRs and the importance of considering the time value of money is crucial for reliable IRR calculations.

Avoid Boiler Damage: Understanding Overfilled Boiler Water Pressure

Distinctive Diagonal Properties: Parallelograms Unveiled

Learn The Mind-Blowing Transformation Of Gummy Bears Submerged In Salt

How To Calculate Irr Calculator Haiper

Internal Rate of Return Formula How to Calculate IRR

How To Calculate Irr From Npv Haiper